Project ID:

LA2004Year Completed:

2024Funding Source:

Statewide Transportation Research ProgramProject Description

Most U.S. metropolitan areas developed alongside the automobile, producing neighborhoods of relatively low density. Consequently, access to opportunities in these neighborhoods is predicated on having an automobile, yet many households do not have the resources to purchase one outright, relying on automobile loans to spread out the purchase price. While automobile loans can enable automobile ownership, they also significantly increase the vehicle purchase price, particularly for non-white consumers subject to discriminatory lending practices.

Moreover, COVID-19 altered travel patterns in the U.S. Studies have analyzed the effect of the pandemic on travel mode, including working from home, but few have focused on automobile ownership—a relationship with potentially long-term consequences for accessibility, household budgets and debt, and policy efforts to meet climate goals.

This project relies on data from the University of California Consumer Credit Panel from Experian to explore two sets of outcomes. First, to understand the association between the pandemic and automobile ownership, this project examines three different automobile loan-related outcome measures: annualized growth rate of new automobile loan balances, average new loan size, and the number of new loans. The project focuses specifically on changes across loans in neighborhoods by race/ethnicity, hypothesizing larger increases in automobile debt in Black and Latino/a neighborhoods, where workers are less likely to be able to telework. The annualized growth rate of new automobile loans increased during the pandemic across all neighborhoods by race/ethnicity, increasing most rapidly in Latino/a neighborhoods. Controlling for other factors, loan size increased similarly across neighborhoods by race/ethnicity. The increase in automobile lending in Latino/a neighborhoods, therefore, likely was explained by a significant uptick in the number of new loans.

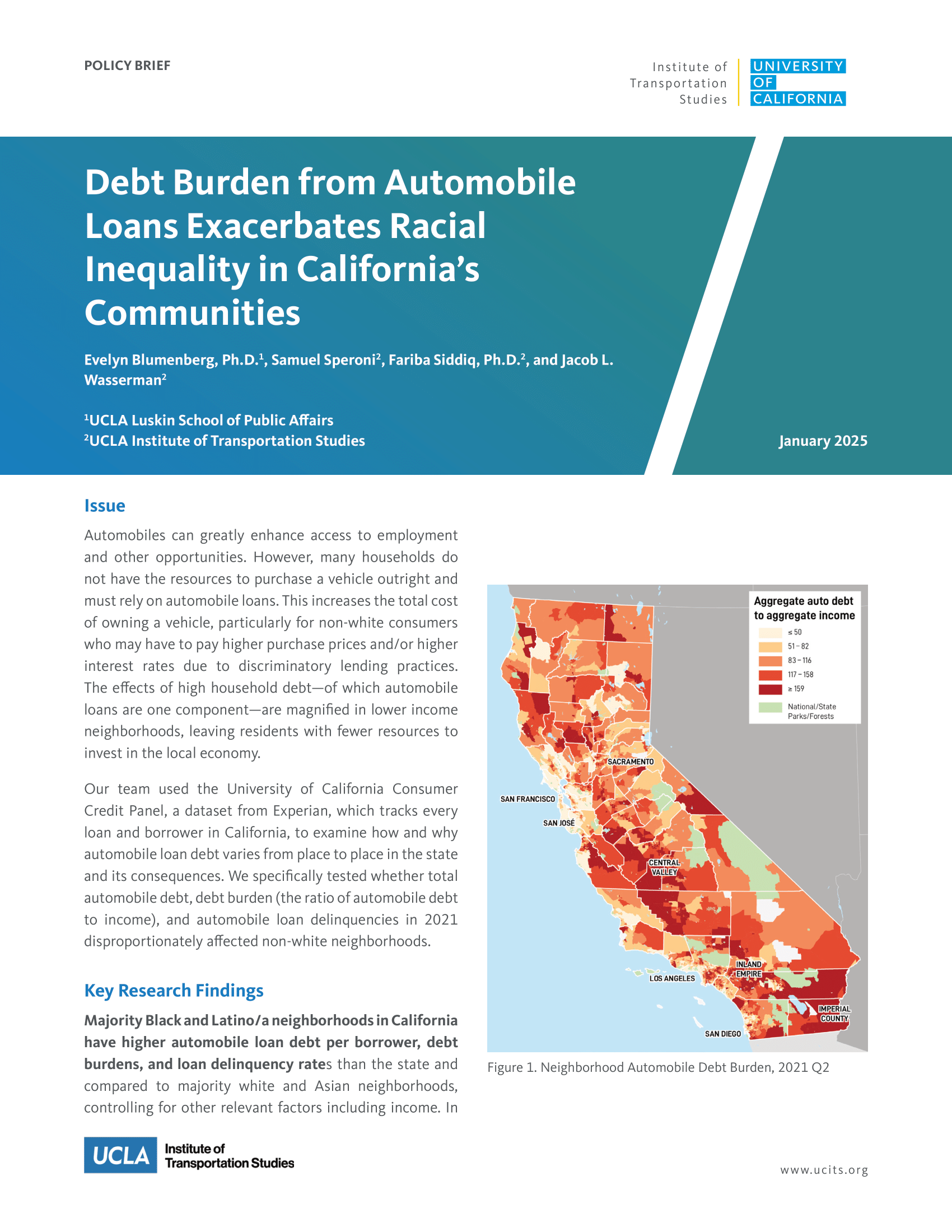

Second, the project explores the determinants and geography of automobile debt and its consequences in California, testing whether various automobile debt measures disproportionately affect non-white neighborhoods. The research finds that, controlling for other factors associated with automobile lending including income, Black and Latino/a neighborhoods have higher total automobile debt, debt burdens (debt relative to income), and automobile loan delinquency rates. In particular, Latino/a neighborhoods shoulder significant automobile debt, while borrowers in Black neighborhoods have the highest delinquency rates. Factors associated with lower total automobile debt and automobile debt burden include better credit ratings, higher residential densities, urban locations, and proximity to rail stations.

The findings underscore the importance of policies to offset the costs of automobile ownership and access. The growth in automobile lending during the pandemic was potentially prompted by pandemic-induced changes in the need for automobiles and facilitated by an expanded social safety net. As the pandemic and its various forms of public financial assistance recede, the findings highlight the value of ongoing assistance in enabling automobile ownership or shared access among households with limited means whose livelihoods depend on the access that vehicles provide. Policymakers should also adopt and enforce fair lending rules to combat discriminatory and predatory practices and facilitate access to high-quality financial institutions and products in communities of color.

Publications

Evelyn Blumenberg (PI)

Research Team

Program Area(s):